schedule c tax form llc

Schedule C is a tax form for. Schedule C is the business tax return used by sole proprietors and single-member LLCs.

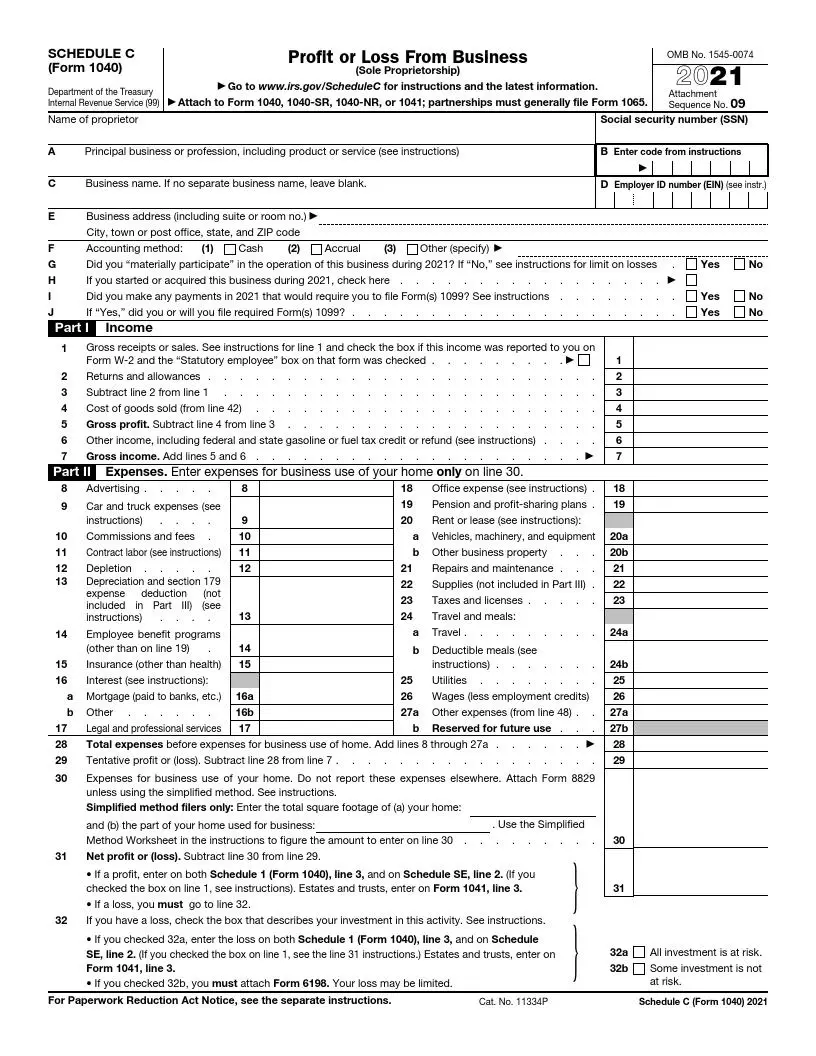

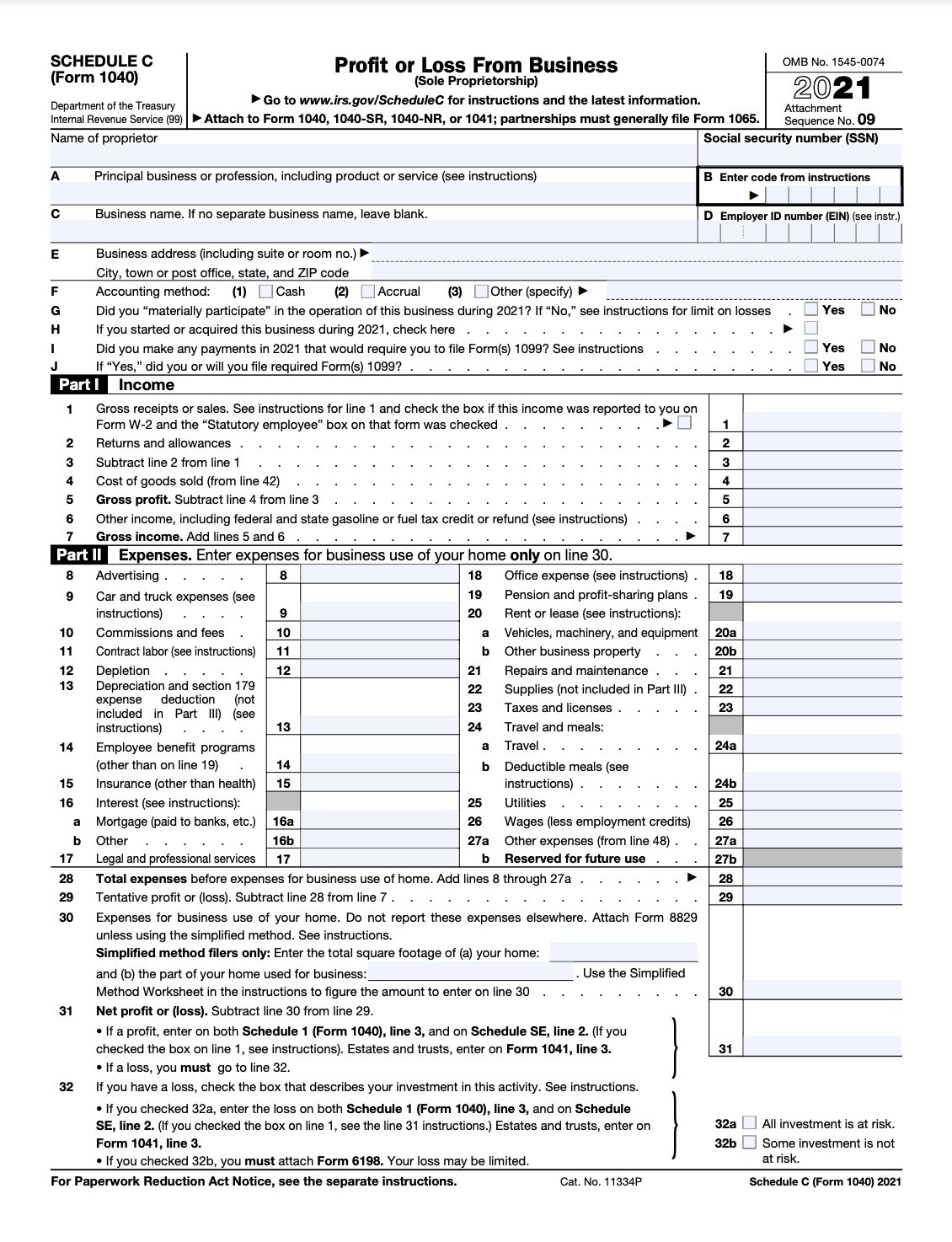

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Form1120S Form 1165 and Schedule C.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

. 272 EXPEDITED SERVICE REQUEST. I started an LLC in the. Its for businesses that are an unincorporated sole.

Sole Proprietorship Taxes Understanding the Schedule C Tax Form. Open the record with our advanced PDF editor. Business Startup Expenses Tax Deduction Guide.

Fill in the details required in IRS 1040 - Schedule C using fillable fields. Schedule C - Special Tax Treatment PA - Generating Philadelphia Form BIRT KY - Form 725 Drake19 Also In This Category Charitable Contributions Form 8821 Sorting 4562 Assets. If you are the sole owner of a limited liability company LLC you must also file a Schedule C tax form.

Include pictures crosses check and text boxes if needed. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. If you received any 1099-NEC 1099-MISC or 1099-K tax forms reporting money you earned working as a contractor or selling stuff youll have to report that as income on Line 1 of.

There are three tax forms that are most relevant to LLCs. LLC vs S Corp The Best Option for Sole Proprietorships. If the only member of the LLC is a.

The LLCs income and expenses are reported on the individuals tax return on Form 1040 Schedule C E or F. On this form California has a minimum LLC tax payable to the Franchise Tax Board of 800 per year with no regard for the sales amounts or your net income or loss. Schedule C Form 1040 is a form attached to your personal tax return that you.

What Is Schedule C. Self-employment income is how we describe all earned income derived from non-W-2 sources. You and your spouse must be the only members of the joint venture.

Its used to report net income for a small business. Youll need to file a Schedule C if you earn income through self-employment as a sole proprietor or as a single-member Limited Liability Company LLC. You and your spouse must both materially participate in the operation of the LLC and you must divide the income and.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. Which tax form an LLC should file is dependent on what election the LLC has. Schedule C is used to report self-employment income on a personal return.

You wouldnt use a. Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. In most cases sole proprietors and single-member LLCs must also fill out.

Schedule C is where you record your business income and expenses and your overall profit or loss for that tax year. An activity qualifies as a business if. The LLC doesnt have to pay taxes.

How To Fill Out Your Schedule C Perfectly With Examples

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Schedule C For Business Taxes Youtube

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

Irs 1040 Schedule C 2020 2022 Fill Out Tax Template Online

Filing A Schedule C For An Llc H R Block

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

2021 Schedule C Form And Instructions Form 1040

What Is Schedule C Tax Form Form 1040

How To Fill Out Your Schedule C Perfectly With Examples

How To Fill Out Your 2021 Schedule C With Example

What Is A Schedule C Tax Form H R Block

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)